The convergence of finance and technology has sparked a revolution, reshaping the landscape of how to manage, invest, and transact money. FinTech has swiftly evolved traditional methods of modern financial systems and offered unprecedented convenience, accessibility, and efficiency. As it cores FinTech encompasses a vast array of technologies innovations designed to streamline financial services, ranging from mobile payment solutions to robo advisors and blockchain-based cryptocurrencies. It’s about creating user-centric platforms that simplify complex financial processes, enhance security and empower individuals as well as businesses to make informed financial decisions in real-time.

What is FinTech Application Development?

To begin with, FinTech application development leverages software development practices, methodologies, and technologies to craft financial applications tailored for both mobile as well as web platforms. The development process typically revolves around the following key phases:

- Define the application’s objectives.

- Identify and address the problems on the application.

- Devise and implement infrastructure that sets application apart from existing FinTech offerings.

- Conduct technical and user testing to assess functionality, security as well as maintain customer satisfaction.

Innovative technologies such as blockchain, machine learning, artificial intelligence, and cloud computing are commonly employed in FinTech development. The technology ensures privacy, security, high performance, and executes financial transactions and services. The elements contribute in delivering advance tailored solutions that will fulfil needs of users in today’s digital revolution.

Next, let’s discuss types of FinTech apps that will benefit both users and businesses while helping them in managing their finances.

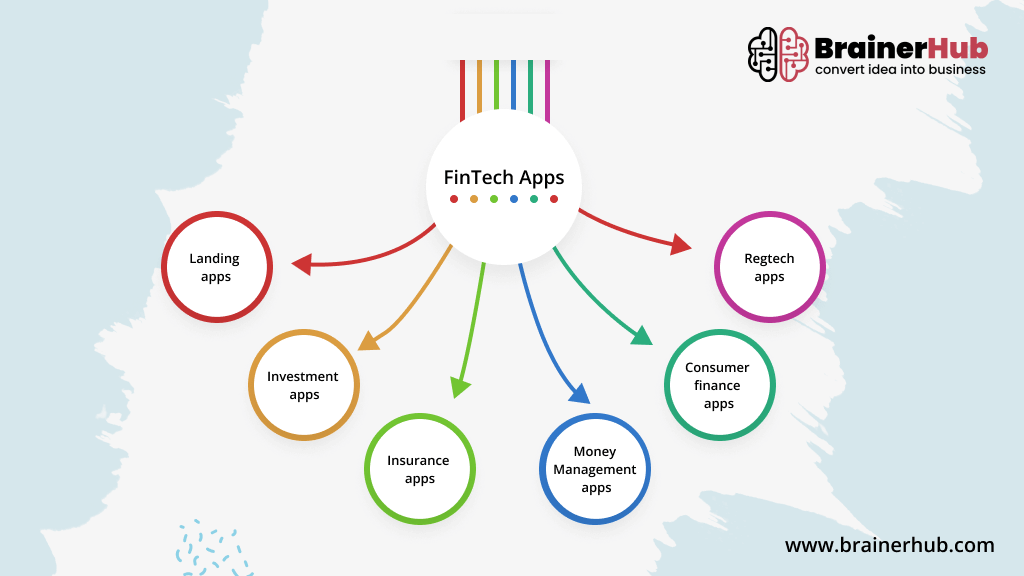

Types of FinTech Apps:

- Landing apps

- Investment apps

- Insurance apps

- Money Management apps

- Consumer finance apps

- Regtech apps

Several companies consider the market potential, understand existing FinTech apps and develop accordingly to fill gaps so they could provide better software for their users. The main focus is on being quick, convenient and easy to access all the financial data. Next, let’s understand the idea around building FinTech application to achieve optimum results.

Benefits of Developing FinTech Application:

- The main objective of developing FinTech mobile application is to broaden market reach and presence.

- It allows to perform financial transactions on the go without any difficulty.

- To provide best possible customer services and experience that will eventually contribute in company’s success.

- Users could easily check account balances, transfer funds and make payments without waiting in long queues.

- The FinTech platform will also help with increasing customer engagement and attract potential targeted audiences to use the application.

- The platform provides top notch security protocols that will let users have faster and safer experience on the application.

- The application ensures to manage all the data at single platform while boosting productivity.

- Advanced FinTech mobile application will simplify fund transfers and loan reviews within minimum time period.

- Overall, FinTech app is user-friendly that has straightforward layouts, dashboard, color schemes to attract potentially larger range of audience.

After acknowledging above mentioned benefits, lets dive in to important features and functionalities that are needed for developing a FinTech application.

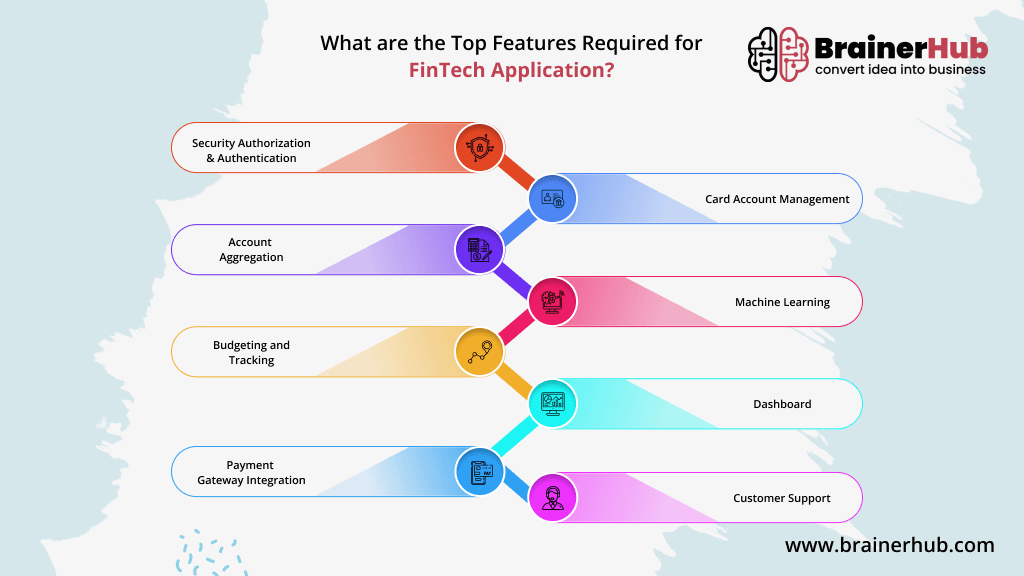

What are the Top Features Required for FinTech Application?

In the competitive realm of FinTech, certain must have features are paramount for success. By incorporating these top features, the applications can deliver exceptional user experiences while meeting the evolving needs of today’s digitally driven financial landscape.

Security Authorization & Authentication

When it comes to FinTech application, it is highly important to prioritize security measures while developing. Professional developers use advance security protocols and integrate technologies like blockchain, biometrics, encryption, two-factor authentication and data obfuscation. Implementing robust security will ensure the confidentiality of users’ personal information and encourage trust amongst targeted audience.

Account Aggregation

Users can check their account balance, make payments, transfer loans, and plan investments from different financial institutes at one single platform. It focuses on providing financial convenience and control without compromising on security protocols.

Budgeting and Tracking

FinTech creates a high-performance platform that provides tools to calculate budget, analyze expenses and track savings that will help users to manage their finances more precisely.

- Payment Gateway Integration

This feature will allow users to make and transfer payments within few clicks. FinTech mobile apps revolve around online payments and offering one stop solutions for all type of saving as well as spending money transactions. One of the few integrations used in FinTech for payment gateways are PayPal, Stripe and others.

- Card Account Management

One of the advanced features provided by FinTech applications are locking and unlocking cards, setting or changing limits, and viewing overall transaction. This will reduce the risk of losing money in any unwanted situations.

- Machine Learning

The evolution of AI and ML has also impacted on FinTech applications. Moreover, the advanced algorithms and models will collect the data from various inputs, analyze it and provide financial advisers on the basis of the evaluation. This feature will suggest users on managing investments as well for profitable benefits.

- Dashboard

With FinTech dashboard, users could monitor their spending, payment history, stock charts and other financial aspects that will help them to make future wise decisions. Users could access the dashboard whenever they wish to within few clicks.

- Customer Support

Financial applications require round the clock customer support feature as they could have queries with many aspects before moving forward with any investments or money transfers. AI chatbots answer and provide necessary financial advisers to customers so they could stay less anxious.

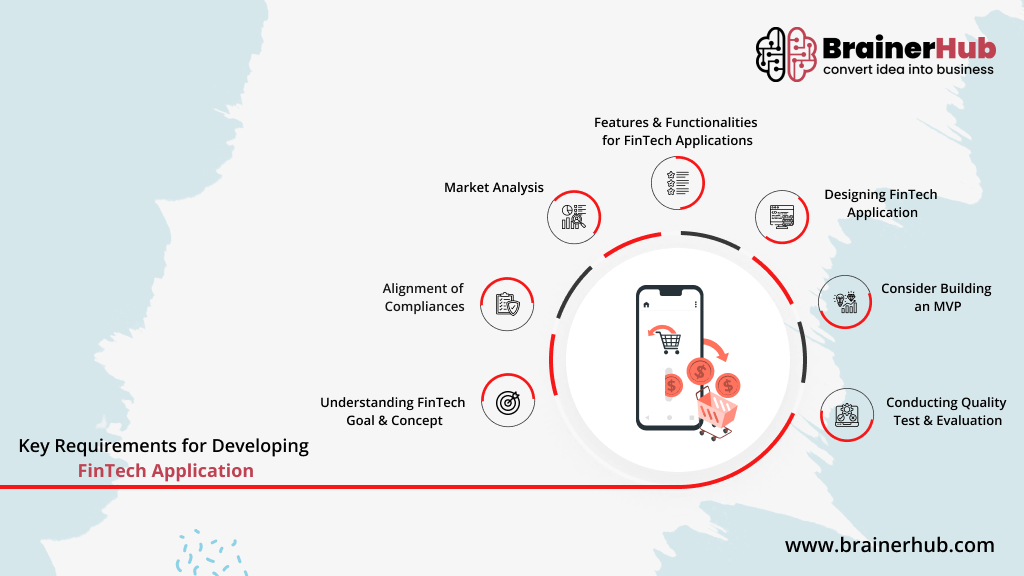

Key Requirements for Developing FinTech Application

1. Understanding FinTech Goal & Concept

The initial stage of developing a FinTech application is to analyze the target audience and choosing niche accordingly. Companies also need to make decision on whether they want to develop a complex FinTech app or upgrade an existing one by introducing unique functionalities and features.

2. Alignment of Compliances

While developing a FinTech app it is important to structure compliances and follow all the necessary guidelines. One should consider privacy laws related to CCPA, GDPR, PIA and LGPD to avoid breach of company’s system. Aligning with legal compliances will reduce the risk of information leak related to user’s identification.

3. Market Analysis

Conducting comprehensive market research and gathering feedback data from targeted audience will help to develop progressive FinTech application. The research will help to fill in the gaps of the applications available in the market and provide better platform for financial transactions.

4. Features & Functionalities for FinTech Applications

As the application grows, companies would want to upgrade, add more features and functionalities that will provide benefits to the targeted audience. Let’s check out basic features for FinTech application that are highly necessary for easy access:

- Secure login through fingerprint, facial or voice recognition and password.

- Generate push notifications for important updates and reminders.

- Tracking user budget and savings.

- Transferring money, checking balances and digital payments.

- Providing securing card payment portals and QR code scanning.

- AI powered chatbot to answer user queries and doubts.

- Additional financial facilities such as buying gift cards, donations and other features.

- Cashback, offers and deals to attract wider target audience.

5. Designing FinTech Application

For designing FinTech mobile application, companies hire professional UI/UX designers who are experienced enough to prepare layouts that will attract potential audiences without compromising on font or font sizes. The main purpose is to provide users smooth experience when they use FinTech mobile experience to transact or invest.

6. Consider Building an MVP

Considering building an MVP if the FinTech application has better market potential and could fill in the criteria gaps for targeted audience. If the application functions well in the market, companies could consider adding more advanced features that will provide immediate tailored financial solutions for the users.

7. Conducting Quality Test & Evaluation

Once the application is launched, it is necessary to evaluate the functionality and progress ratio. Next, to enhance existing features or develop new ones conducting A/B testing phase is highly essential as it collects user feedback data. This will improve FinTech app and focus on providing smooth experience while browsing.

How much does it Cost to Develop Advance Version of FinTech Application?

Generally, developing a basic FinTech application would cost between $20,000-$30,000. Companies would want to up their market game and build an advance version that will fit in the loop holes and fulfil all the financial criteria. If the company is targeting niche, developing advance version of FinTech application would cost approximately around $60,000 to $120,000. The estimation of developing an application depends on different factors such as maintenance, support, marketing, updates, development platform, team location and more.

Final Thoughts on Developing Successful FinTech Application

To conclude, FinTech app development offers platform for financial innovation and growth. It focuses on improving and upgrading features that will help to achieve new heights from technology perception. From simplifying payment modes to easy investment process, users could find all financial solutions without compromising on security protocols. Developing a successful FinTech application requires a holistic approach that encompasses user experience, security collaboration, and innovation. By prioritizing these elements, entrepreneurs can position themselves for success in revolutionizing the future of finance.

Want to Develop FinTech mobile App for your Business?

Look no further! Contact our professional mobile app development team at BrainerHub Solutions for more information & development assistance!

FAQs

The main agenda of FinTech application is to integrate with varying financial systems and APIs that will facilitate seamless transactions as well as provide users with best possible services. The platform handles user data, implements authentication and encryption protocols while offering user friendly interfaces. FinTech applications have top notch security for transferring funds, making payments, managing investments, monitoring, tracking and accessing user’s financial details.

In general, developing a FinTech application considers many factors such as complex features, integrations, team sizes, development, secure payment portals and other advance features. It might take few months to a year of time period for building an ideal application.

The key categories for FinTech applications are insurance, investment mobile applications, digital payments and money lending apps. The high-performance platform provides efficiency and smooth financial transactional experience.